Costs of low-end PCs would possibly fall as shortly as in all places as quickly as additional, as Intel talked about Thursday that its scarcity of “small-core” microprocessors is easing. Intel then as soon as extra faces an oversupply of flash reminiscence, which ought to help hold down the costs of SSDs and completely completely different flash-based merchandise.

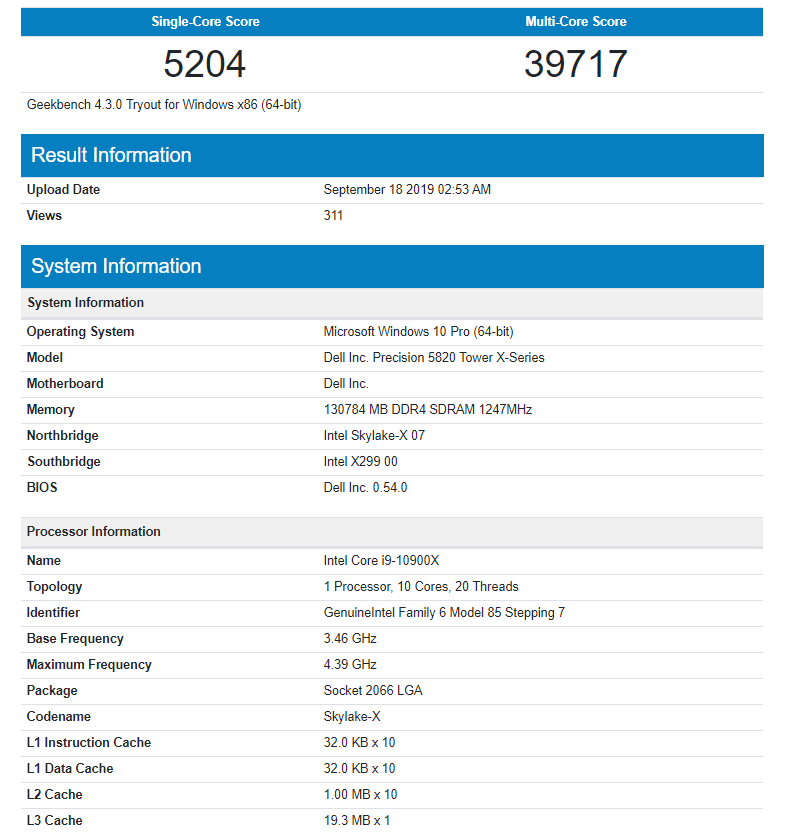

Intel’s second-quarter outcomes, reported Thursday, exceeded the corporate’s personal expectations. Intel earnings have been down 17 % to $4.2 billion, whereas earnings fell comparatively by the use of 3 % to $16.5 billion. Partially, that’s on account of stock and manufacturing bumps as the corporate transitioned to its 10nm merchandise, alongside facet Ice Lake, which Intel has talked about earlier than now’s now present.

Intel now has two 10nm factories manufacturing silicon, chief authorities Bob Swan talked about. Intel’s commonplace manufacturing slowed whereas these factories ramped up, which the corporate described in earlier revenue calls. In keeping with Swan, Intel misplaced a “little little little little bit of percentage” all by way of the second quarter, as the corporate prioritized its higher-margin, “large core” microprocessors. All through that point, Swan talked about, Intel was as soon as not able to meet title for for its cheaper chips.

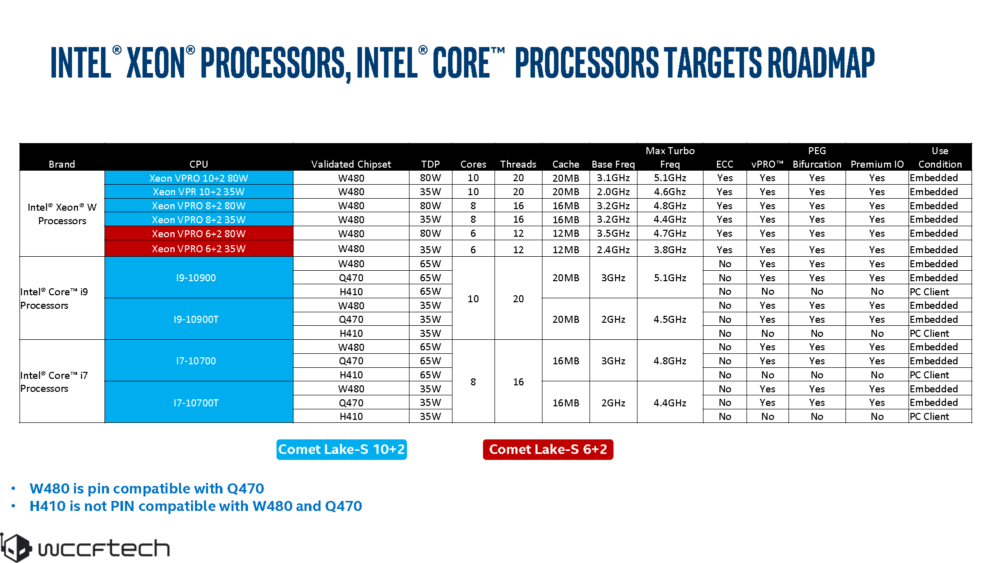

In 2021, Intel expects to transition to the 7nm manufacturing course of node, an aggressive enterprise of tempo which will put Intel one other time on the tempo of enterprise outlined by the use of Moore’s Legal guidelines, Swan talked about. By way of his estimation, Intel’s 7nm course of may be aggressive with the 5nm course of experience he expects Intel’s pageant to be the utilization of by the use of then.

Although Swan talked about that Intel’s second-quarter effectivity was as soon as larger than its personal expectations, Swan talked about he’s then as soon as extra anxious by the use of the Trump Preserve watch over’s ongoing tariff was as soon as with China, alongside facet the uncertainty regarding the Division of Commerce entity doc. Throughout the quarter, the U.S. authorities positioned Huawei, an infinite Chinese language language language language language experience firm, on the Commerce entity doc, basically forbidding U.S. corporations from doing commerce with it. Later, 5 Chinese language language language language supercomputer corporations joined the doc. Swan didn’t title Huawei or the choice firms by the use of title, alternatively he did say that uncertainty over the China state of affairs “makes me rather further frightened,” Swan talked about.

Intel’s PC-centric Shopper Computing Employees then as soon as extra represents the overwhelming majority of Intel’s earnings, with the dep. reporting 1 % further earnings, $8.Eight billion, than the an an an an identical quarter a 12 months so far. Intel’s Knowledge Heart Employees reported $5 billion in earnings, down 10 % all by way of the face of stronger pageant from AMD and its Epyc chips. Intel furthermore owns numerous smaller firms, alongside facet its automonous using group of workers, MobileEye ($201 million in earnings, up 16 %), and its Programmable Options Employees, which recorded $489 million in earnings, down 5 %.

Unsurprisingly, Intel purchased off its 5G smartphone modem enterprise to Apple for roughly $1 billion, after Apple was as soon as compelled right right correct proper into a gift cope with Qualcomm on account of Intel’s reported incapacity to meet manufacturing targets.

Intel’s Swan didn’t say the rest about Intel’s ongoing paintings work to enlarge its discrete graphics chips, let on my own reference AMD or Nvidia, its chief pageant. AMD, which is engaged in a GPU dogfight with Nvidia and in CPUs with Intel, tales on July 30.